In the midst of rising steel prices, and concerns in some corners about steel product lead times, steel production and product availability appear to be in good shape.

Shipments up in January

Steel shipments got off to a good start in 2021 — rising 5.3% in January, according to a NW Indiana Times report citing data from the American Iron and Steel Institute (AISI).

United States steel mills shipped 7.42 million tons of steel in January, up from 7.04 million tons shipped in December, NWI Times reported.

However, the January 2021 steel shipments were down 13.1% from 8.53 million tons shipped in January 2020, the media outlet also acknowledged.

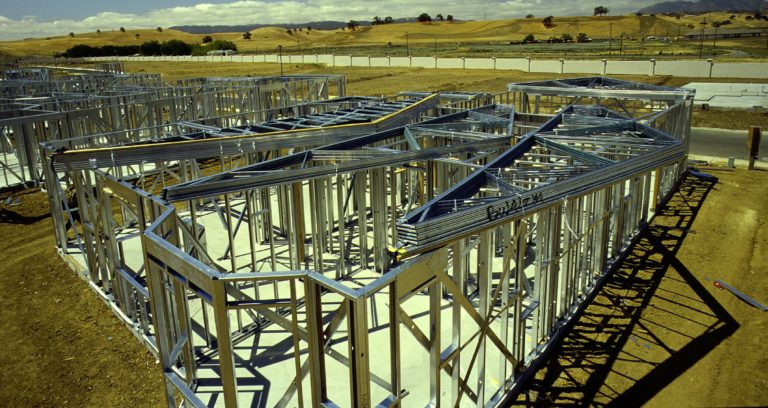

Speaking of cold-formed steel (CFS) framing component of the steel industry, Larry Williams, executive director of the Steel Framing Industry Association (SFIA) said shipments of CFS studs and track are currently at healthy levels.

“We’ve made it a year through this pandemic, so to see the overall steel numbers ticking upward in 2021 is good,” Williams said. “Shipments are moving in the right direction, and cold-formed steel providers I speak to are all optimistic.”

Reports released by SFIA have shown that total manufacturing volume of CFS framing products rebounded strongly in the second half of 2020.

High lumber prices have driven more projects to consider using steel stud framing instead of wood.

Steel capacity utilization on the rise

In other news, Metal Miner reported that the U.S. steel sector’s capacity utilization rate grew incrementally for the week ending March 13, 2021 — rising to 77.7% capacity utilization.

Steel production reached 1.76 million net tons for the week ending March 13, said Metal Miner, reporting AISI data. The 77.7% capacity rate during the week marked an increase from 77.4% the previous week.

One year ago for the same week, steel production was 1.74 million net tons at a capacity utilization rate of 75.3%, AISI data show.

For the current calendar year, steel production has totaled 17.87 million net tons at a capacity utilization rate of 76.7%. Output this year is down 6.8% from the same period last year, when capacity utilization reached 79.6%, according to MetalMiner.

“There is certainly strength in the steel industry overall,” said Williams, commenting on the AISI data. “Reports show that we have more capacity available to fill North American’s building needs, especially as high lumber prices drive more projects to consider using steel stud framing instead of wood.”

In fact, lumber costs soared more than 30 percent this year, nearly tripling since last spring’s deep drop in economic activity, says a Bankrate article, citing National Association of Home Builders data.

“Skyrocketing lumber prices are tacking thousands of dollars onto the cost of a new home, an unwelcome increase for buyers already struggling to find homes they can afford,” the Bankrate article says.

Bullish view on steel fundamentals

Last week, United States Steel Corporation, a Fortune 250 company, released its first-quarter guidance to investors saying that current market conditions are strong.

“Solid market fundamentals, low steel supply chain inventories, continued consumer-driven demand, and pent-up infrastructure demand has us increasingly bullish,” said U.S. Steel President and CEO David B. Burritt.

U.S. Steel expects adjusted net income in the first quarter to come in at $160 million, excluding special items.

“Healthy flat-rolled customer demand across most end-markets and the flow-through of higher steel prices are resulting in substantially higher results from our Flat-rolled and U. S. Steel Europe segments and our newly formed ‘Mini Mill’ segment, which will showcase the performance of Big River Steel,” Burritt said.

U.S. Steel recently acquired the remaining stake in Big River Steel.

More information

Lumber Prices Skyrocket, Steel Provides Cost-Effective Solution

Article cited from BuildSteel.org